Trading opens up a world of opportunities for everyone. Whether you’re a professional trader looking to diversify your portfolio, a beginner trader seeking to learn from market experts, a busy professional looking to complement your primary source of income, or a business person hedging against some unknown future risk to your bottom line. Here are seven great opportunities that trading opens up to you.

1. Access to international tradable assets

Most trading platforms offer one-point access to nearly every tradable asset class globally. That means you can trade crypto, Forex, stocks, ETFs, indices, and CFDs from a single account. Depending on the asset class you choose to trade and your trading strategy, you can trade whenever you want 24/7.

Usually, when one financial market closes in one time zone, another opens up. For example, when European markets close around 4.30 PM GMT, the American markets open. So, you can have your pick of assets to trade. Forex trading is round the clock throughout the weekday. And when the stock and Forex markets close over the weekends, you can trade cryptos, which are available 24/7.

2. Access to leverage and margin trading

Trading opens you up to leverage and margin trading opportunities, which allow you to trade significantly larger positions compared to your capital. Margin trading allows you to increase your buying power, with a loan from your broker or crypto exchange. And with leverage trading, you can trade CFDs up to 2000X of your initial deposit.

A point to note here is that although trading on margin and using leverage will significantly increase your potential profits, they aren’t without risks. You risk portfolio liquidation and margin calls if a trade doesn’t go your way.

3. Exploiting market downturns with shorting

One of the biggest advantages of trading is it allows you to short and potentially profit during recessions or bear runs. In reality, markets are cyclical, with periods of booms and bursts. Trading not only allows you to profit when a particular asset increases in value but also to take advantage when prices fall. And whichever asset you trade, it means you can position yourself to profit regardless of how the market moves.

4. Earning passive income

While for most people trading is a full-time primary job, when done properly, it can also be an ideal source of passive income. Thanks to copy trading, you can automate trading in your account. Nowadays, most trading platforms allow users to automatically mirror trades executed by other traders.

This means you don’t necessarily need to be an expert trader to profit from the markets; simply find a profitable trader and copy their trades. This frees you to pursue other activities. The crypto market also has various innovations such as staking, farming, and DeFi lending. They allow crypto holders to earn passive income on their portfolios.

5. Capitalize on geopolitics

All financial markets are primarily driven by forces of demand and supply. Geopolitical events influence market sentiment, which in turn drives demand and supply. Trading allows you to capitalize on geopolitical events and domestic political, economic, and policy developments in foreign countries. And thanks to globalization and technology, you have access to real-time data and news events. So, even though you’d be thousands of miles away, you can exploit these events by targeting tradable assets that are likely to be highly impacted.

6. Hedging

Trading provides hedging opportunities to individuals whose primary economic activity is not trading. Let’s say you’re a business person, and you fear that future interest rates, inflation, or adverse price fluctuations will likely hurt your bottom line. In this case, you can use futures, forwards, Forex swaps, or options contracts to hedge against the unknown inherent risks.

You can also hedge against inflation and interest rates. Although forward contracts have counterparty risks, they allow the counterparties to customize their agreement however they prefer. And you can do this for virtually any industry.

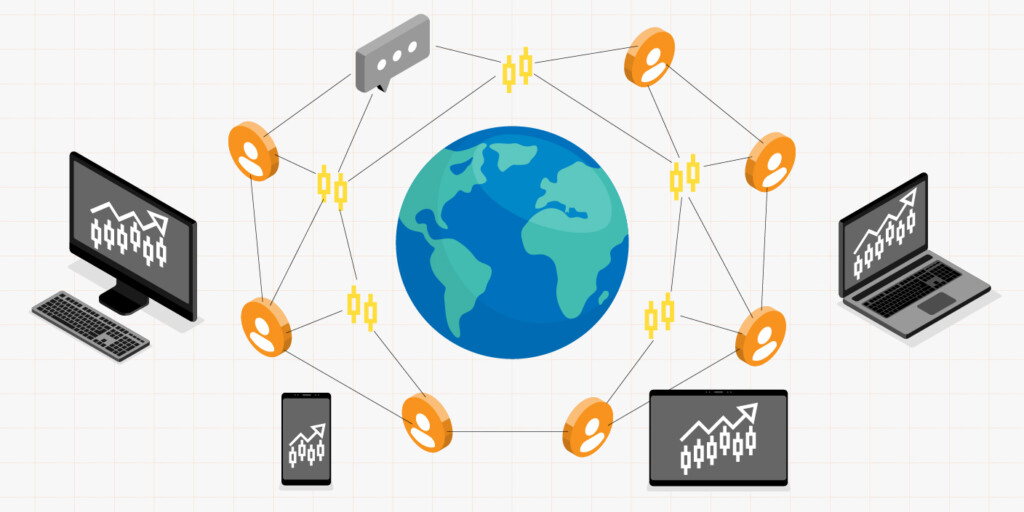

7. Be part of a community

Trading is purely online, and it deliberately brings together like-minded people. Whether you’re a part-time or full-time trader, trading brings together individuals with a common goal, creating a community of like-minded people. Effectively, trading opens up a world to which you would, otherwise, never have access.

Typically, most trading platforms are social platforms, allowing users to interact with each other and exchange ideas, just as they would on social media. It meshes up expert traders with years and professional expertise with novice traders, who are just starting out.

The Bottom Line

There are thousands of tradable assets from different asset classes. And thanks to technology, all traders, regardless of where they’re from, have access to real-time data, and expert analysis, which evens out the playing field for expert and beginner traders. And while the end goal in trading is to make profits, we’ve covered seven great opportunities that trading opens up to you.