The following article will discuss everything a new trader needs to know about the different types of orders. We will discuss the difference between a market order and a limit order and explore the various stock market order types and their costs.

Market order vs. Limit order

Limit and market orders are the two main order types that every investor should be aware of.

Market order

Market order refers to the standard type of trade where a trader places an order and buys or sells a commodity immediately at the current rate. The amount one pays to acquire a commodity will often be at or close to the posted ask. If one decides to sell a commodity, one will get a value equal to or close to the published bid.

One factor to remember is that the value at which the market order will be processed may differ from the value at which it was sold. The price at which one executes the deal might vary from the quoted price in quick-moving markets.

Investors who wish to purchase or sell stock quickly are the ones to prefer market order. Moreover, using market orders, they can be sure that the transaction will be placed and processed as soon as possible.

Market orders for stocks that trade above a large number of shares daily will probably be fulfilled near the bid prices, even if the investor is unaware of the actual price at which the stock is likely to be purchased or sold.

Limit order

A limit order is also called a pending order; this type of order enables buyers and sellers of securities to trade at a specific price at a future date. If the cost exceeds the pre-defined amount, this order form will be employed to execute a transaction. If not, the order won’t be completed.

A great example to understand this is that if investors want to purchase a stock at $5, they can choose to enter a limit order at this price. Once they do so, they wouldn’t be able to spend any more funds on the stock above $5. However, they could still be able to purchase it at a price below the $5 per share mentioned in the order.

It is also essential for investors to be aware of the four types of limit orders in the share market. It includes two buy orders and two sell orders:

- A Sell Stop is an order where one purchases securities below the market cost. A sell-stop order will only be activated once a specific price point has been achieved.

- A Buy Stop is an order where one purchases securities at a higher price point than the current market price. A buy-stop order becomes active when a specific price point has been achieved. A way to distinguish between buy-stop orders and sell-stop orders is to sell the former above the market price and the latter below the market price.

- A Buy Limit is an order where securities are bought at or under a specific price. A buy-limit order should be posted on the appropriate market segment for them to raise the price effectively. It entails setting the demand for a buy-limit order at or under the current market price.

- A sell Limit is an order to sell a commodity at or higher than a given price. This order should be made at or higher than the current market demand to guarantee a better price.

Note! A limit order establishes the highest or lowest amount at which one is ready to purchase or sell.

Price of market and limit orders

Investors should be aware of additional fees when choosing between a limit order and a market order in the share market. Generally speaking, if we compare market price vs. limit price, market orders have lower costs than limit orders. The commission gap might range from a few dollars to higher than ten dollars. For instance, if one decides to add a limit limitation on their market order, the market order fee can hike from ten to fifteen dollars. This is why it is crucial to ensure that your limit order is profitable before you submit it.

For example, if a broker asks $8 for a market order and $13 for a limit order. You wish to purchase stock ABC at $48.90 per share, but it is now trading at $51 per share.

You can purchase 11 shares using a market order for $561 (11 shares at $51 each) plus an $8 fee for a total of $569. By putting up a limit order for 13 shares at $48.90, you would spend $648.7 total ($635 + $13 fees).

The savings from buying shares at a lower price are not very different, and they become smaller if the order’s additional expenses are eliminated. Moreover, there is still a possibility that the price won’t drop to $48.90 or less in the context of a limit order. So, if it keeps going up, you could miss your chance to purchase.

Additional stock order types

Now that you know what order types in the share market are, it is time to discuss a few limitations and special instructions that several brokerages may have on their orders.

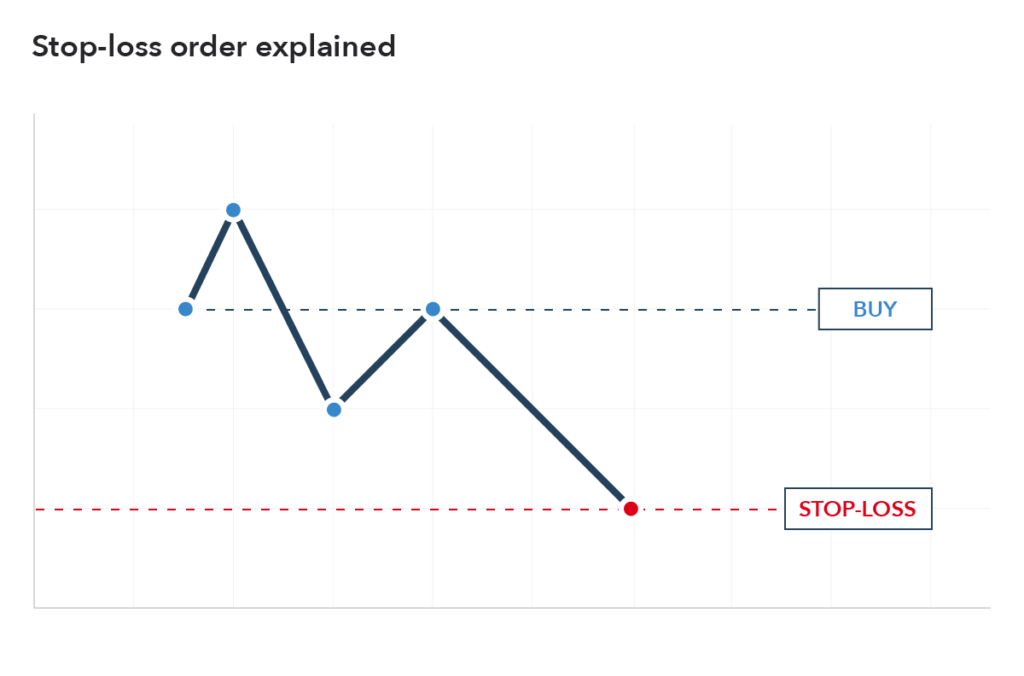

Stop-Loss order

A stop-loss order is among the most helpful order type in the market. It is also known as an on-stop buy, a stopped market, or an on-stop sell. In contrast to market and limit orders, which become activated right after they are entered, this type of order is distinct since it is inactive until a specific value is reached. Once that happens, it becomes activated as a market order.

For example, if you placed a stop-loss sell order on ABC shares at $46 per share, it cannot be made active till the value reaches or falls under $46. The stocks would then be traded at the highest bid value as the order would convert into a market order.

Stop-Limit order

Stop-limit orders are pretty identical to stop-loss orders. However, as their name suggests, they have a limit on the value at which they’ll activate. A stop-limit order contains two specific values:

- Stop price: It transforms the order into a sell order.

- Limit price: The sell order becomes a limit order, which can only be executed at or above the limit price in the stock market.

It can decrease a possible issue with stop-loss orders, which could be activated when prices drop and then quickly rise during a flash crash.

All or None (AON)

If you are one of those people who purchase penny stocks, this kind of order is very significant for you. With an all-or-none order, you are guaranteed to receive either the total amount of commodity you ordered or nothing.

When an order has a limit, or perhaps the commodity is highly volatile, this is often troublesome. An all-or-none limitation prevents your order from becoming fulfilled until at least two thousand shares at your desired price are available.

Moreover, the same happens in the scenario when you place an order to purchase two thousand shares of ABC, but only a thousand are being sold. If you don’t specify the all-or-none limitation, your two thousand share order would only be partially completed for 1,000 shares.

Immediate or Cancel (IOC)

Any portion of an order which can be completed within the market ) in a short amount of time must be filled following an IOC order, and the remaining portion must be canceled. The order is fully canceled when no shares are exchanged in the immediate time frame.

Fill or Kill (FOK)

This form of order merges an IOC specification with an AON order, requiring the total order size to be traded in a relatively short time, sometimes a few seconds or even less. The order is canceled if neither requirement is fulfilled.

Good ‘Til Canceled (GTC)

It is a deadline that you may set for specific orders. An order that is “good until canceled” will be in effect till you decide to terminate it. Brokerages often set a 90-day restriction for how long you may hold your order open.

Day

The order will generally be established as a single-day order if the GTC directive does not provide a time window for expiry. It indicates that the order will expire at the end of the working day. You must reenter it the following trade day if it fails to complete.

Take Profit

A take-profit order is intended to close out the trade at a profit once it has reached a certain level. It is always connected to an open position of a pending order.

Note! Not all online trading systems or brokerage firms do not support limit or market order types. If you do not yet have access to an order type that you would like to execute, we recommend speaking to your broker about the order types they offer.

The bottom line

For individual investors, understanding the distinction between a market order and a limit order is essential to ensure they make the best decisions. The investing strategy also determines the order type.

Since a market order is less expensive and the investment choice depends on factors that will pan out across months or years, the current market price is not that big deal for an investor looking to make a long-term investment. However, if an investor aims to operate on a shorter-term movement throughout the charts and is significantly more aware of the market amount paid, in this situation, a limit order to buy in with a stop-loss order to sell is often the absolute minimum.

FAQ

Which is better, market orders or limit orders?

A market order is your wisest option if you need to close a trade quickly. In contrast, a limit order is the best order type if getting a particular value on a stock sale or purchase is essential. Even with the same stock, your choice may alter over time.

What are some trading fundamentals?

Trading securities in a day, or even in a few seconds, is known as day trading. Nothing about it relates to investment in the conventional sense. It is taking advantage of the regular up-and-down price swings throughout trading hours.

Why are limit orders denied?

Limit orders that are too far away from their value can be declined. For instance, if you order to purchase a share for $84, but it is only trading at $2 right now, your order cannot be accepted. These rejections guarantee that orders process swiftly during instances of unexpectedly high trading activity.