Putting all of one’s funds into a single trade is a common mistake that many newbie traders and investors make. It occurs even more often if the trader has succeeded before. Therefore, it’s vital to remember that markets are highly volatile; even if your strategy works in one trade, it can fail in another.

Did you know that the average success rate of a day trader is only 10%? One of the reasons for such a low percentage is wrong position sizing. There are numerous techniques you can apply to your strategy, but you should remember to adjust them to your investing style and the balance.

What is position sizing?

Position sizing is the size of a position in a portfolio or the amount of funds an investor or trader puts in one trade. The position size varies significantly and depends on the trader’s account balance, risk tolerance, and experience. Position sizing can be applied to various investment types, but it’s more common in currency trading.

Traders and investors apply various position size methods to control risks. Some of them you can find below.

1. Fixed position size

Setting a fixed position size is one of the simplest approaches, as it requires no calculations. Therefore, it’s one of the methods traders and investors begin with. The rule is that you decide how much funds you can place in one trade and stick to this amount in every position you open.

Imagine your account balance is $1000. You can put the whole amount in one trade or divide it into 10 so that you risk only $100 per position. There are no doubts the strategy is effective as you reduce risks 10 times.

2. Fixed risk per trade

Another option is to set a fixed percentage of the account you can risk per trade. For instance, if your initial account balance is $1000 and you decide to risk 1% of the overall balance, you can lose $10 per trade. If your balance declines to $900, you will risk only $9 per trade. However, if your account rises to $1100, you will risk $11 per trade. This strategy is even safer than the first one, as it will allow you to risk less if your total capital drops.

3. Maximum risk per all opened trades

Regardless of your trading style, you likely open a few trades simultaneously. As you can’t be sure all of them will be successful, it’s worth limiting the risk per all open trades. For instance, you can decide not to trade over 20% of your capital simultaneously. That is, if you reach the limit, you need to wait until at least one trade is closed. This will allow you to control your emotions and reevaluate risks.

4. Fixed stop-loss percentage

The common strategy is to apply a risk/reward ratio that says your potential profit should be at least two times bigger than your potential loss. Therefore, before you place a trade, you need to identify the target the price may reach and divide it at least by 2 to calculate the stop-loss size.

The fixed stop-loss percentage means that, regardless of the take-profit target, you will place the stop-loss order at the percentage of the current price. For instance, if the stock price is $200, and your stop-loss percentage is 5%, the stop-loss order should be placed at $190.

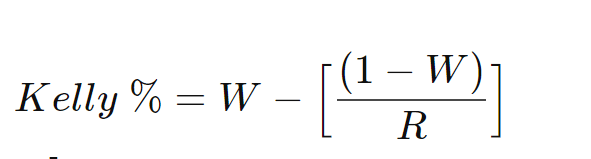

5. Kelly Criterion

The Kelly Criterion strategy was developed by John L. Kelly. It is usually used to maximize the return rate by evaluating the wealth-to-risk proportion in a positive expected value trade sequence.

The formula is:

Where:

Kelly % = capital per trade

W = percentage of winning trades of a particular strategy

R = historical win/loss ratio

To determine the position size with the Kelly Criterion, you need the following:

- Calculate the percentage of successful trades in relation to overall trades. You can determine the number of trades yourself.

- Calculate the ratio of successful trades to your losing trades.

Takeaway

Position sizing is one of the cornerstones of trading and investing. You should always calculate your funds and be sure you can cover all potential losses. Don’t rely on chance, and don’t overestimate your strategy just because of one successful trade.

Jack Schwager, an investor and author, said: “There is no single market secret to discover, no single correct way to trade the markets. Those seeking the one true answer to the markets haven’t even gotten as far as asking the right question, let alone getting the right answer.”

Sources:

Kelly Criterion: Definition, How Formula Works, History, and Goals, Investopedia

Position Sizing in Investment: Control Risk, Maximize Returns, Investopedia