Monitoring market volatility is crucial to maximizing profits and mitigating risk as an investor. You can make more informed trading decisions by tracking indicators that reflect volatility in the stock market. Whether you are a short-term trader or long-term investor, understanding these volatility metrics helps determine optimal entry and exit points.

This article will explore three key volatility indicators – the CBOE Volatility Index (VIX), the Average True Range (ATR), and Bollinger Bands – that every trader should follow. By learning how these volatility measures work and how to interpret them, you will gain valuable insight into the overall health and stability of the market. Market volatility is an inescapable reality, but with the right tools, you can navigate uncertain waters and reach your investment goals.

Understanding Market Volatility and Volatility Indicators

To trade the stock market, you must understand volatility and how it impacts your investments. Volatility refers to the amount of uncertainty or risk involved with the size of changes in a stock’s value.

Top 3 Volatility Indicators

Volatility indicators are tools traders use to measure market volatility and make better trading decisions. There are a few indicators every trader should know:

- VIX: The Volatility Index, or VIX, is a popular measure of the stock market’s expectation of volatility over the next 30 days. A high VIX means investors expect a lot of volatility, while a low VIX means relative stability is expected.

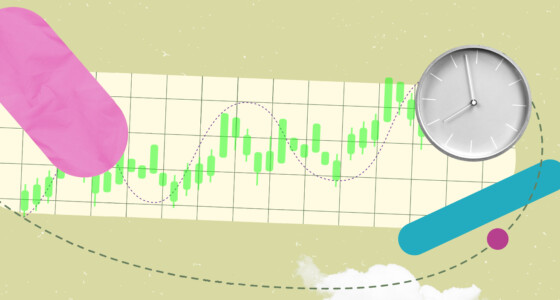

- Bollinger Bands: Bollinger Bands measure volatility by plotting three bands around a stock’s moving average. When the bands widen, it means volatility is high. When the bands narrow, it signals lower volatility. Traders can use these bands to determine good entry and exit points.

- Average True Range (ATR): The ATR indicator measures a stock’s volatility over a specific time period. It calculates the average distance between a stock’s high and low prices. A higher ATR means the stock has been more volatile. Traders use the ATR to set stop losses and determine optimal position sizing.

Monitoring these indicators helps traders gauge market volatility and sentiment. By understanding volatility, you can make smarter trading decisions, set proper risk levels, find the best entry and exit points, and ultimately become a more effective trader. Staying on top of volatility is key to navigating the stock market.

The VIX – The Most Widely Used Measure of Volatility

The VIX is the CBOE Volatility Index, which measures expected volatility in the S&P 500 index options over the next 30 days. It is commonly called the “fear gauge” of the stock market since higher readings indicate more volatile and risky market conditions.

How the VIX Works

The VIX uses real-time S&P 500 option bid/ask quotes to calculate the expected volatility for the next 30 days. It measures the market’s expectation of future volatility by averaging the weighted prices of S&P 500 puts and calls over a range of strike prices. The VIX increases when there is a higher demand for puts, indicating investors expect greater volatility and risk. Conversely, the VIX decreases when call demand rises, signaling expectations of less volatile, bullish markets.

Many short-term traders use the VIX to determine good entry and exit points. When the VIX spikes, it often indicates a short-term market bottom and a good buying opportunity. When the VIX plunges, it may signal a market top and a chance to take profits. However, the VIX should not be used alone – it should be combined with price action and other indicators to confirm any signals.

The VIX is a valuable metric for gauging market sentiment and volatility expectations. Following the VIX, traders and investors can better understand market risk levels and uncover potential trading opportunities. Used properly, the VIX can provide an edge to your analysis and help improve your timing.

Bollinger Bands – Visualizing Volatility Changes

Bollinger Bands are a type of statistical chart characterizing the prices and volatility of a market or security. They consist of three bands that are plotted in relation to a security’s price:

- The middle band is a simple moving average that serves as the base for the upper and lower bands.

- The upper band is plotted as a set number of standard deviations above the moving average.

- The lower band is plotted the same number of standard deviations below the moving average.

How Bollinger Bands Measure Volatility

The standard deviation of the security price determines the width between the upper and lower Bollinger Bands. As volatility increases, the bands widen to encompass a higher degree of price movement. When volatility declines, the bands narrow to reflect the lessened range of price fluctuations.

Analyzing the Bollinger Bands, you can determine when a security’s price is relatively high or low, and you can identify periods of low or high volatility. When the bands tighten, it often signals decreasing volatility and the potential for a sharp price move in either direction. When the bands widen, it suggests increasing volatility and stronger price momentum.

Many technical traders use Bollinger Bands to determine opportune times to buy or sell a security. For example, when the price reaches the lower band, it may indicate the security is oversold and due for a reversal. When the price touches the upper band, the security could be overbought and ready to pull back. Crossing the moving average in the middle can generate buy or sell signals.

In summary, Bollinger Bands are a useful visual tool to evaluate a security’s volatility and potential trading opportunities. Analyzing the width of the bands, in relation to the price and moving average can provide insight into peaks and troughs in volatility and trend reversals in the market. For active traders, Bollinger Bands are an essential indicator to determine optimal entry and exit points.

Average True Range (ATR) – Capturing Volatility Across Time Periods

The Average True Range (ATR) is a technical indicator that measures market volatility by decomposing the entire range of an asset price for that period. This metric is calculated by averaging the true range, which is the maximum of the high minus the low, the absolute value of the high less the previous close, and the absolute value of the low less the previous close. ATR is usually measured over a 14-day period and is expressed as a percentage of the current stock price.

If the ATR percentage is increasing, it means the stock price is fluctuating more widely between the high and low prices. This indicates the stock has become more volatile. Conversely, if the ATR percentage is decreasing, it signals the stock price is moving in a narrower range, indicating lower volatility. As a trader, a rising ATR percentage presents more opportunities to capitalize on larger price swings, whereas a declining ATR percentage is more suitable for less active trading.

The ATR indicator can be applied to any actively traded security or index, such as stocks, bonds, commodities, and currencies. When the ATR rises, it suggests the market is becoming unstable. This often happens during periods of economic uncertainty or around significant news events. During stable market conditions, the ATR will usually be at lower levels.

ATR can be used on all timeframes, from 1-minute to monthly charts. On shorter timeframes like 1-minute or 5-minute charts, ATR will be more sensitive to small price changes. On longer timeframes like daily or weekly charts, the ATR will reflect broader market volatility. Using ATR on multiple timeframes can provide a better sense of short-term and long-term market fluctuations.

In summary, the Average True Range is a versatile indicator that can gauge volatility across all markets and time periods. Monitoring ATR levels helps traders determine the best times to trade based on volatility conditions and can lead to higher probability trades. Knowing how to interpret the ATR indicator is an important skill for any active trader.

Putting Volatility Indicators to Use in Your Trading Strategy

Once you understand the various volatility indicators, the next step is determining how to apply them to your trading strategy. There are a few effective ways to utilize volatility indicators:

Identify Potential Breakouts

When volatility is low, it could signal an impending breakout in the stock price. Low volatility means there are fewer price fluctuations and less trading activity. This often precedes a significant price movement. Monitor your chosen volatility indicator and watch for levels to drop, indicating lower volatility. Then, look for a breakout in price action, as this could signal the start of an uptrend.

Manage Risk Exposure

Volatility indicators are also useful for managing risk. Higher volatility means wider price swings and more uncertainty. When volatility rises, tighten your stops to avoid large losses if the trend reverses. You may also want to decrease your position size since the chance of loss is greater. Conversely, lower volatility signifies stability and less risk. You can give your stops more room and potentially increase position size.

Identify Changes in Trend

Shifts in volatility can also signal a change in trend. For example, if a stock has been steadily rising with low volatility, then volatility suddenly spikes, which could indicate the uptrend is ending. The price may have reached a peak and is due for a reversal. On the other hand, a drop in volatility during a downtrend could signify the selling pressure is easing, and an uptrend may start.

In summary, volatility indicators provide valuable information about potential price movements, risk levels, and trend changes. When integrated properly into your trading system, these indicators give you an edge in navigating the financial markets. Remember, no indicator is foolproof, so always use proper risk management and consider volatility indicators in the context of the overall trend and market conditions.

Conclusion

Your achievements as an investor can depend heavily on your ability to understand market volatility. By following indicators like the VIX, Bollinger Bands, and the Average True Range, you gain insight into potential risks and rewards in the market. Keep a close eye on these metrics, set appropriate stop losses, and adjust your positions accordingly. With practice, you’ll develop an intuitive sense of the market’s moods and learn to navigate turbulent times. Volatility is inevitable, but with the right tools and temperament, you can use it to your advantage. Stay vigilant, think critically about every trade, and keep learning – that is the path to long-term success as an investor.